What are the new regulations?

Strong Customer Authentication (SCA) comes into effect on September 14th and will result in changes to how your European customers make online payments. Two-factor verification will now be required in order for consumers to pay for goods and services online. The purpose of this directive (PSD2), brought about by the EU, is to make payments more secure and will have implications for both businesses and consumers. You can get a deeper understanding of the topic here.

What It Means For Your Business

The rollout of SCA will be gradual. Starting from next week, more of your members will be directed to a 3D Secure page when first entering their card details. Each bank will have its own 3D Secure workflow but, it will typically involve members entering a code received via text message.

There is a chance that some of your members’ recurring credit card payments will require additional verification. This second factor of authentication may occur upon entering their card details initially, or upon subscription payment.

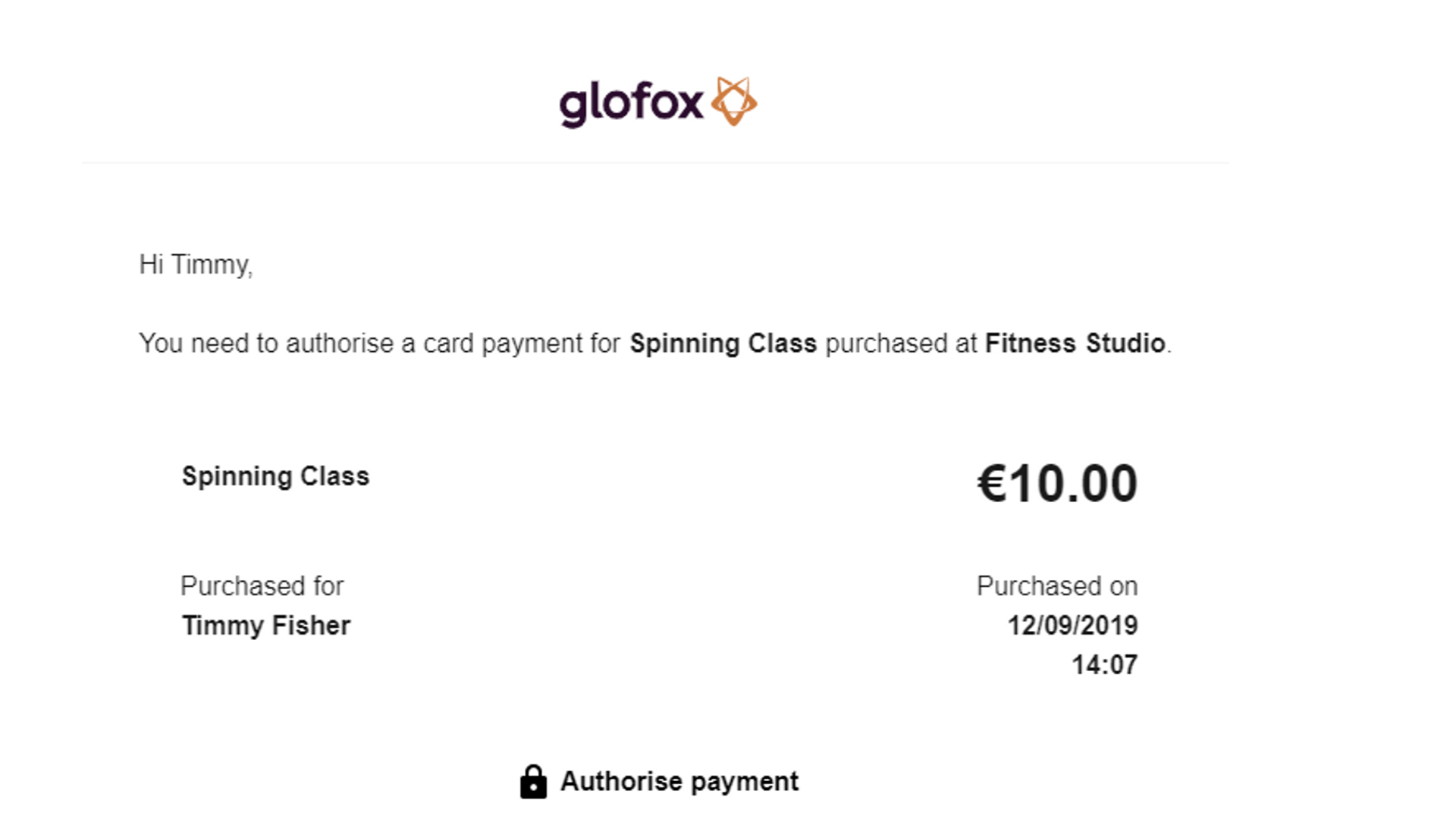

If authentication is required, our credit card processor, Stripe, will ask for additional verification. Your member will then receive an email from Glofox with a request to verify the transaction. Once they receive the email they will click on the link, and the payment will be approved.

What Can Go Wrong?

If a payment is pending verification, but a customer has not received an email or cannot find it, you can resend the email from the Glofox dashboard. If the issue persists, please contact us.

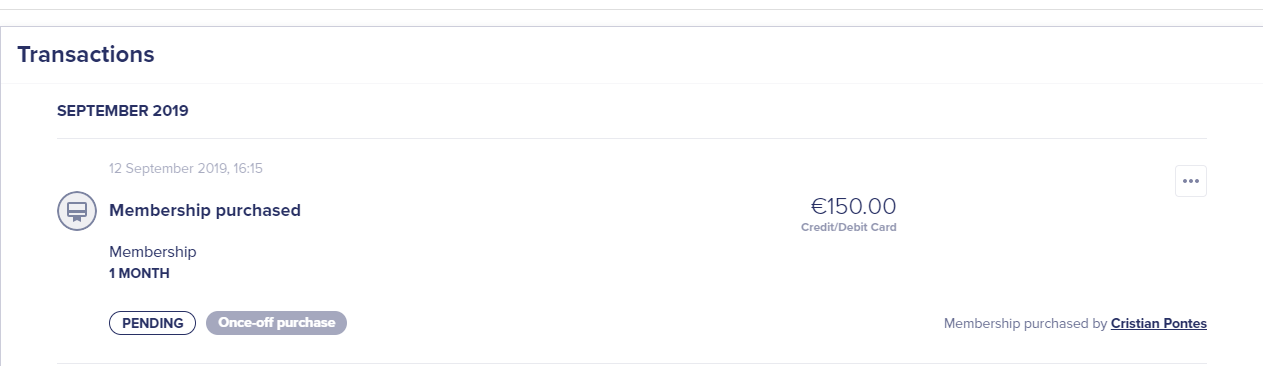

Payments pending verification will be flagged in your transactions list in Glofox Reports and will also be made visible on the Member Profile. You may then need to contact the customer and request them to click the link in their email.

For more information on SCA check out the Glofox Knowledge Base.